COMERCAM released its annual Publico Informe on the state of mezcal and, as always, it is a lot to absorb. I’ve taken the liberty of culling through the report and pulling various mezcal sales and export numbers to give a snapshot of what happened in 2024.

First, the big picture

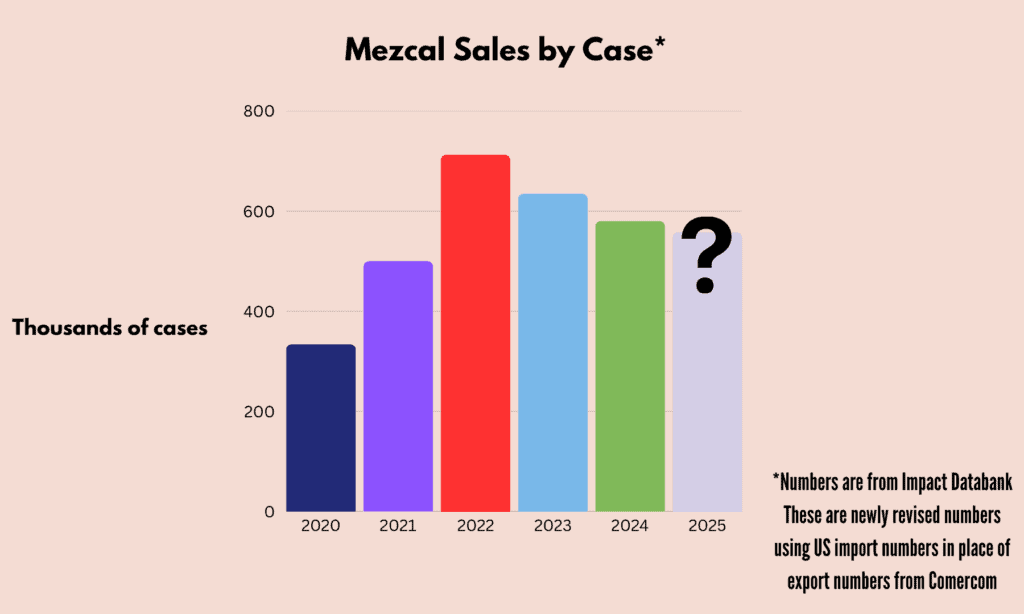

Getting mezcal sales numbers is no easy feat and we are reliant on organizations like Impact Databank, which use a variety of sources to pull their numbers. In the past, Impact Databank created reports based on the COMERCAM export data, but this year they made the decision to use US Commerce Department numbers.

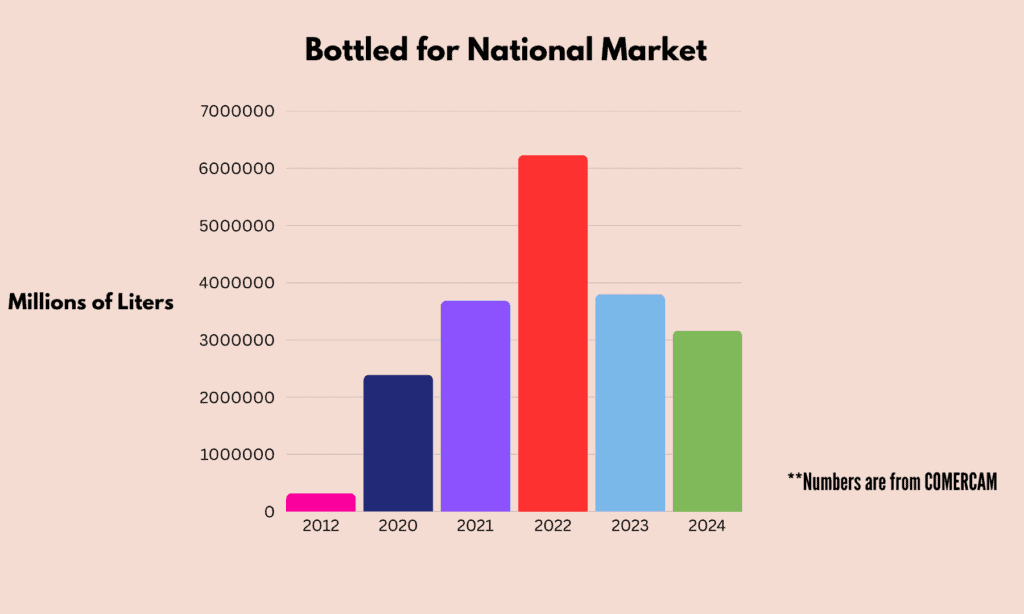

The above chart is their revised data for the past four years. As you can see, 2022 is the high point of sales since data has been tracked. Since then, sales have trended down or flat. It remains an outlier year, with sales bouyed by the pandemic when people were on an alcohol buying binge. The market has slowly been coming back to earth, though it is important to remember that sales remain well above pre-pandemic figures. Additionally, while the rest of the spirits market has fallen, agave spirit sales have remained relatively flat or just slightly below 2023 numbers.

I have been looking for deeper dives into the US mezcal sales trends in 2024 but thus far, it is proving difficult. This year’s DISCUS report was light on information about agave spirit sales and looked deeper into the RTD sales trends (booming!). I think part of the reason why it’s so hard to get sales data for mezcal is that it’s only around 1.5% of the agave spirits market. The last report from SipSource showed mezcal volume growth was down by 3.7% from March 2024 to March 2025, and revenue growth the same period was down 4.2%. Only tequila reposado sales were showing growth (up 17.6% by volume, 22.6% by revenue), with the total agave spirits category growth at 1.3%. As more than one importer told me, they would be happy with flat sales for 2025.

Now, the deep dive

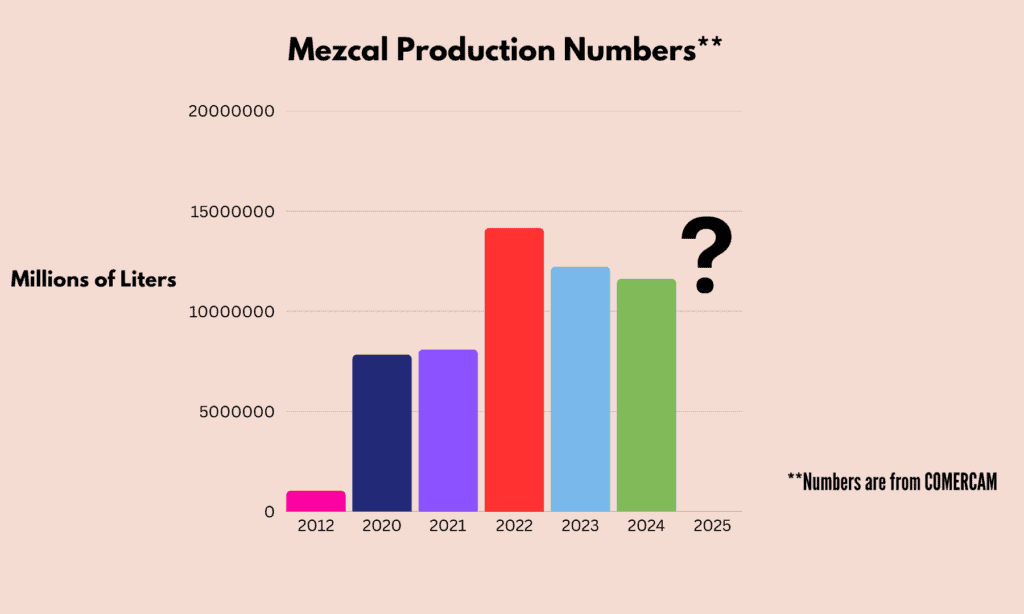

The COMERCAM numbers represent about 96% of all certified mezcal numbers. These numbers do not register any non-certified mezcals, what is labeled destilados de agave, or regional mezcals such as raicilla and bacanora. In other words, this is not a complete picture of total mezcal production.

Mezcal production in 2024

In 2024, 11,362,436 liters of mezcal were produced, compared to 12,239,655 liters in 2023. and 7,145,039 in 2019. Again, 2022 remains the anomaly with 14,165,505 liters produced. Oaxaca remains the top producer.

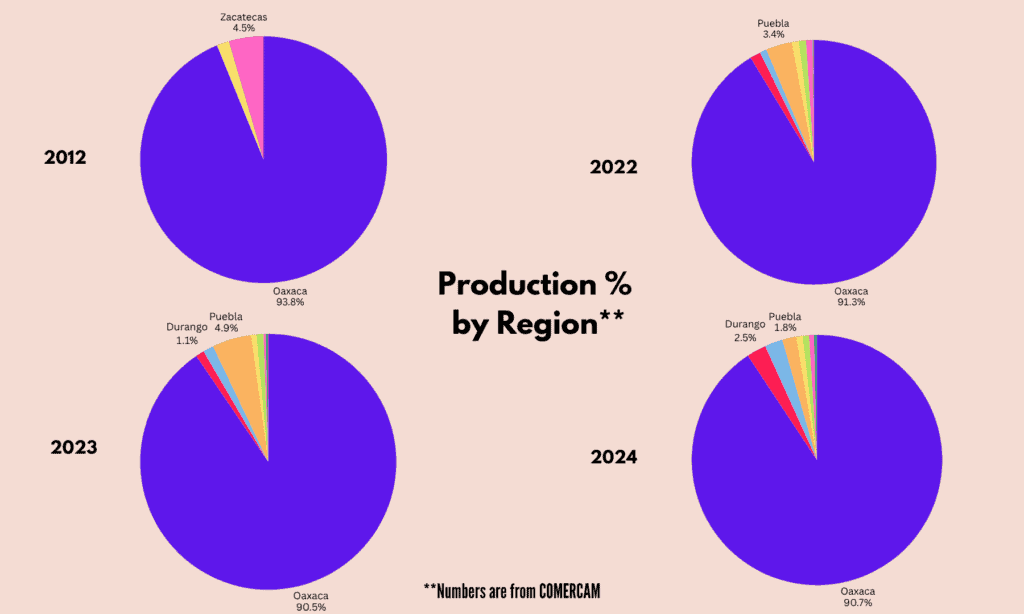

Mezcal production by state

What’s interesting about the regional breakdown of mezcal production is how much things have changed when it comes to other states and their production. In 2012, Zacatecas had 4.5% of the production; in 2024 it was .64%. In 2023 and 2023, Puebla seemed to be pushing forward with 3.4% and 4.9% respectively, but in 2024 it only had 1.8% of the production. Durango and Michoacan were the states that saw the biggest jump in production from 2023, 1.07% and 1.33% respectively, to 2.52% and 2.32% respectively.

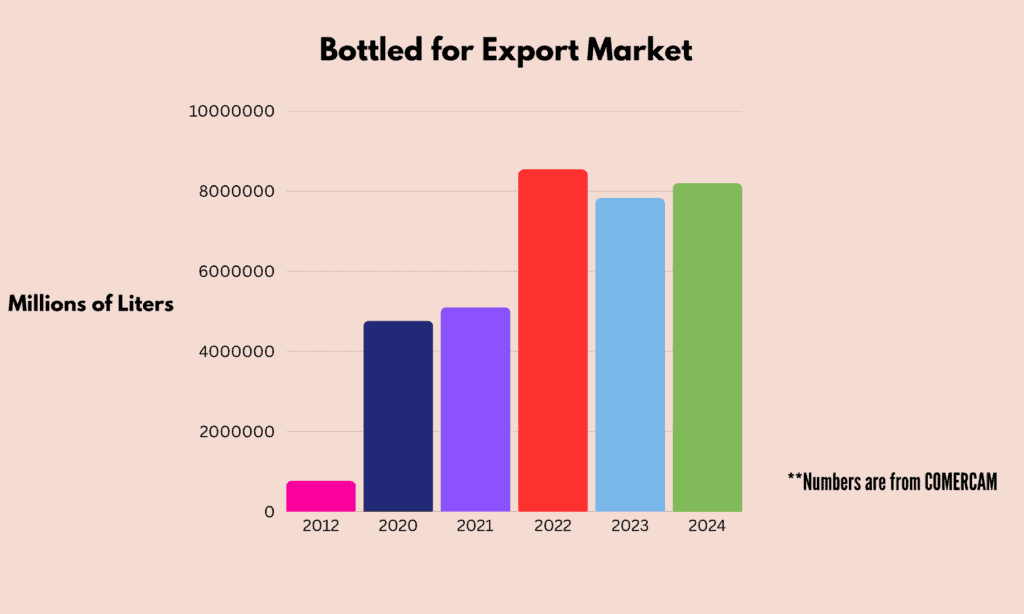

Also interesting was to look at what was bottled for the export market- 8,201,043 liters. But if you compare that to the Impact Databank number of 5,223,600 liters, that is a difference of 2,977,443 liters. The COMERCAM report doesn’t break down the export markets and the amounts. So unless Europe and Asia took a huge leap forward in 2024, it is likely that a good percentage of that production is still waiting to be exported.

Mezcal exports in 2024

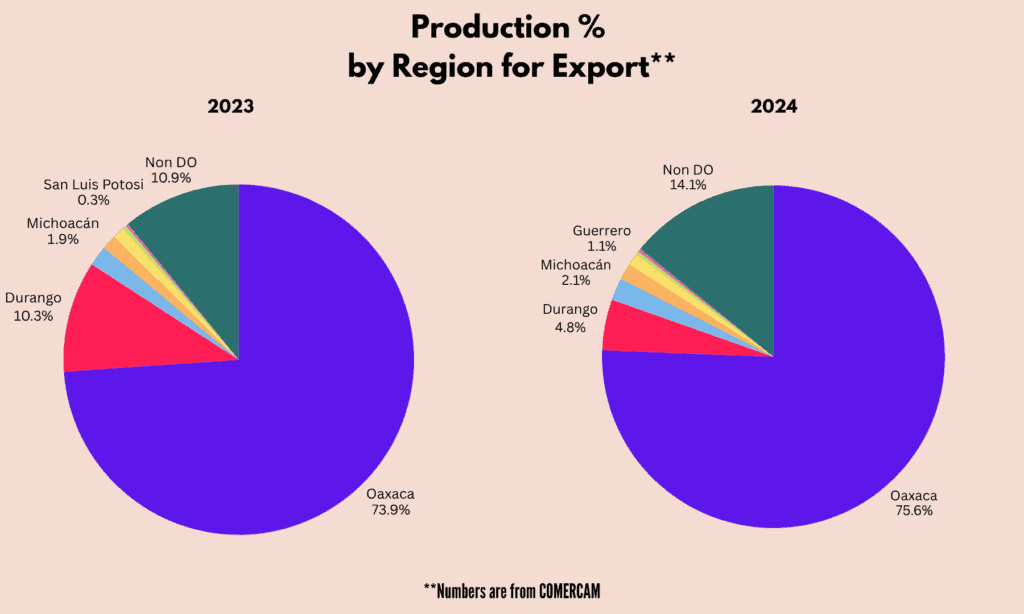

It’s also interesting to note regional production for export, and specifically the change in Durango from 2023 to 2024 and the Non DO number, meaning uncertified for whatever reason, for that same period of time. This is not a figure I have previously seen noted.

Which states produced the most mezcal for export in 2024?

Something that really surprised me was the drop in production bottled for the national market, as anecdotally I have heard that the national market has been growing.

How much mezcal is bottled for domestic sale?

Oaxaca also remains the top producer for the national market with 74.9% of the production, followed by Puebla at 16.34% of production. Interesting, Puebla’s share in 2023 was 27.15% of the market.

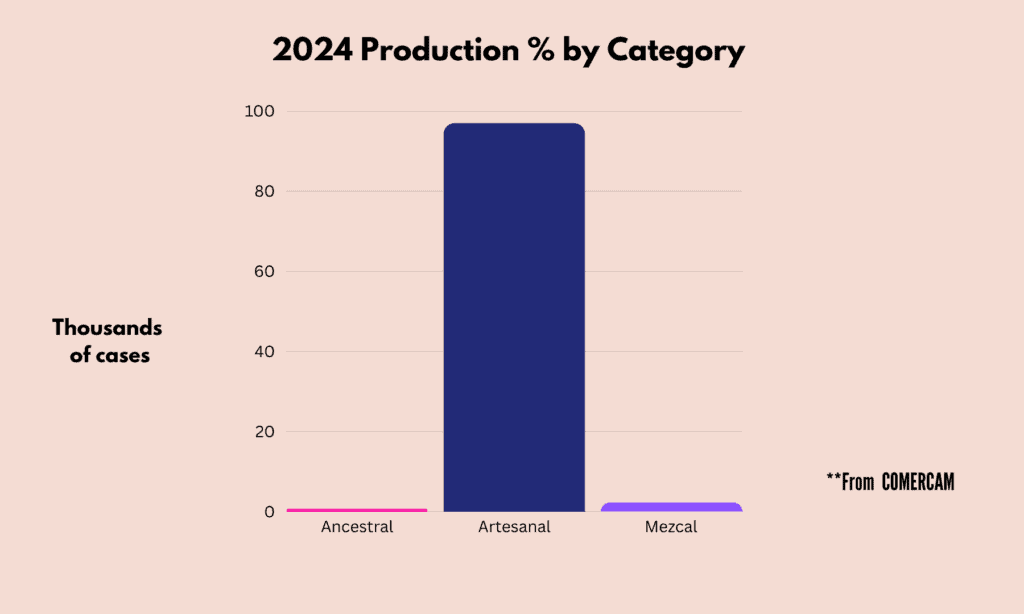

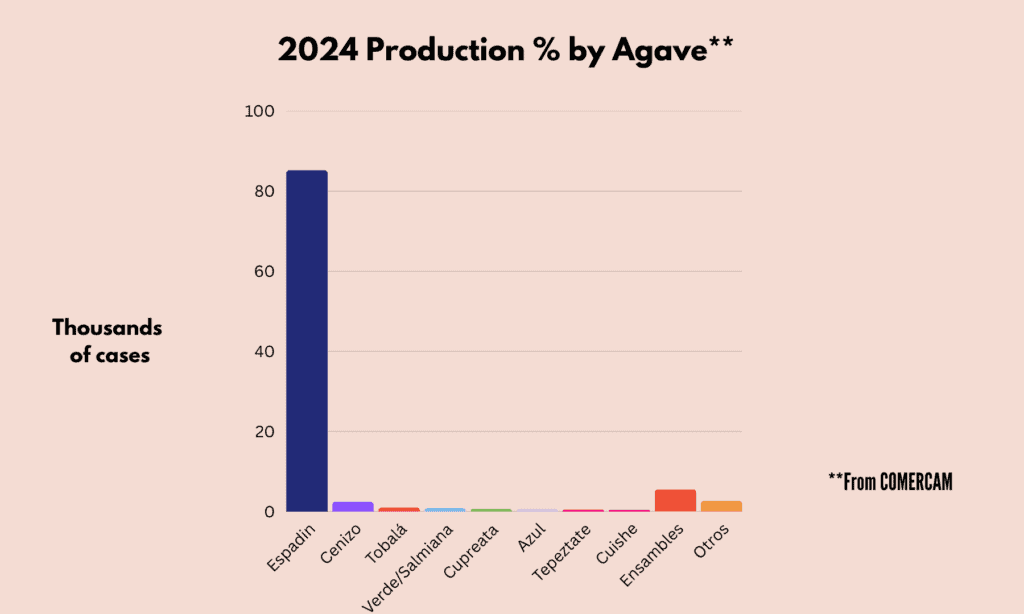

The most popular category of mezcal and other numbers

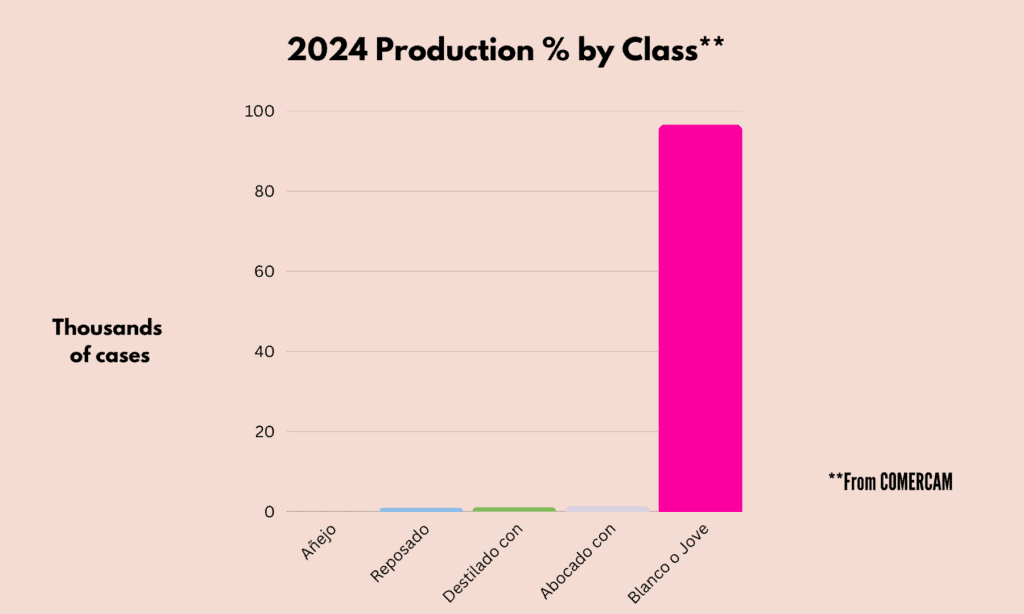

None of the above numbers are surprising as these have remained pretty consistent over the years – Artesanal Mezcal remains the dominant category and blanco or joven the dominant class.

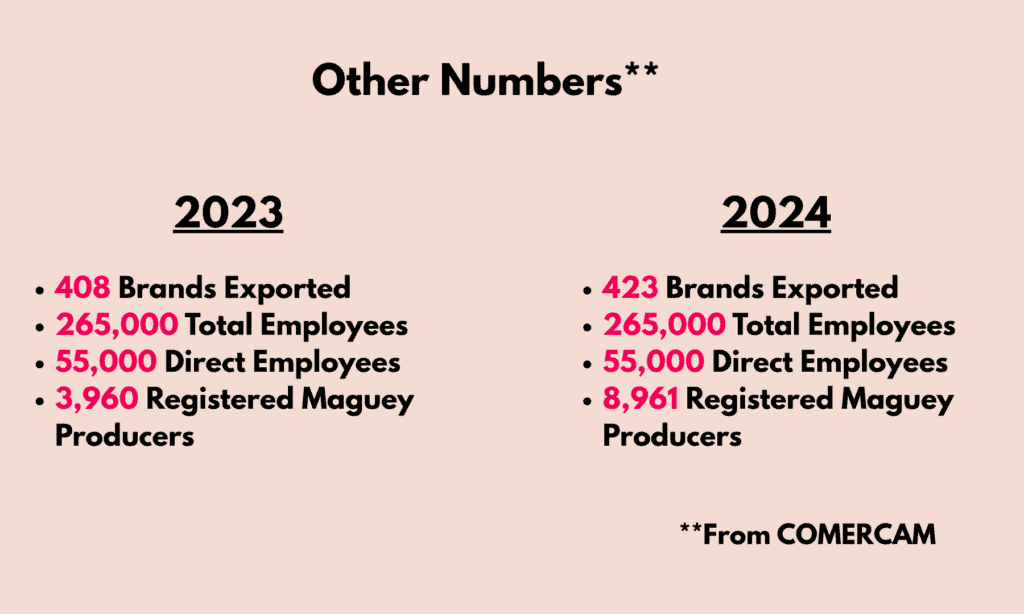

And again, epadín is the dominant agave used in production, followed by ensambles and cenizo. Employment remains consistent, though it would be great to get an understanding of the breakdown of type of employment. And while the number of new brands slowed, the number of registered maguey producers exploded which could signal a glut of agave down the line

So what does it all mean?

- The 2025 best case scenario is for a flat to slightly down market. Between the tariff questions that dominated the first quarter of the year and uncertainty about the economy, both in Mexico and the US, any growth is unlikely.

- Move beyond cocktails! The continued dominance of the espadín (the backbone of mezcal cocktails) is an achilles heel for the category. Despite the clear lessons from tequila, the lack of diversity of agaves in the mezcal market means a continued push to plant more espadín, deforesting hills and creating continual environmental concerns.

- We need to drink more mezcal by exploring other regions. There is a huge and long history of agave production in all of Mexico and by concentrating our interest on only one area, we are truly missing out on diversity of agave spirits and putting too much pressure on one state to produce so much mezcal.

Check out the full report here.

Leave a Comment