Or at least some of it

The challenging thing with sales data is that it takes a while to get the full picture of what is happening or happened.

Take 2025 mezcal sales. It’s almost the end of February and we still don’t have a full picture of what happened in 2025 and likely won’t until May, when COMERCAM releases its annual report.

The big picture

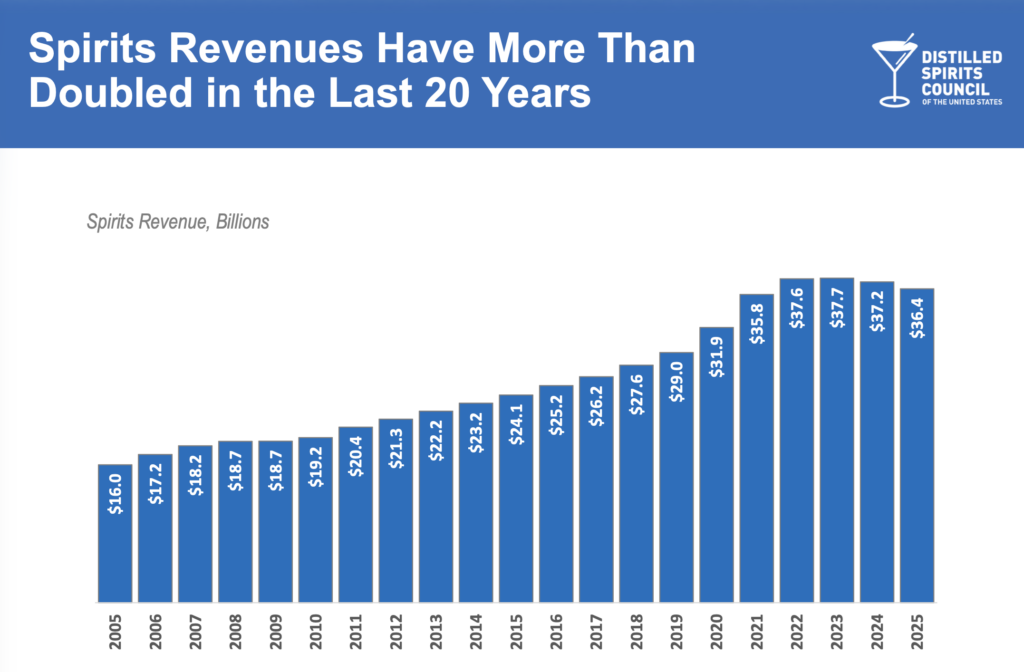

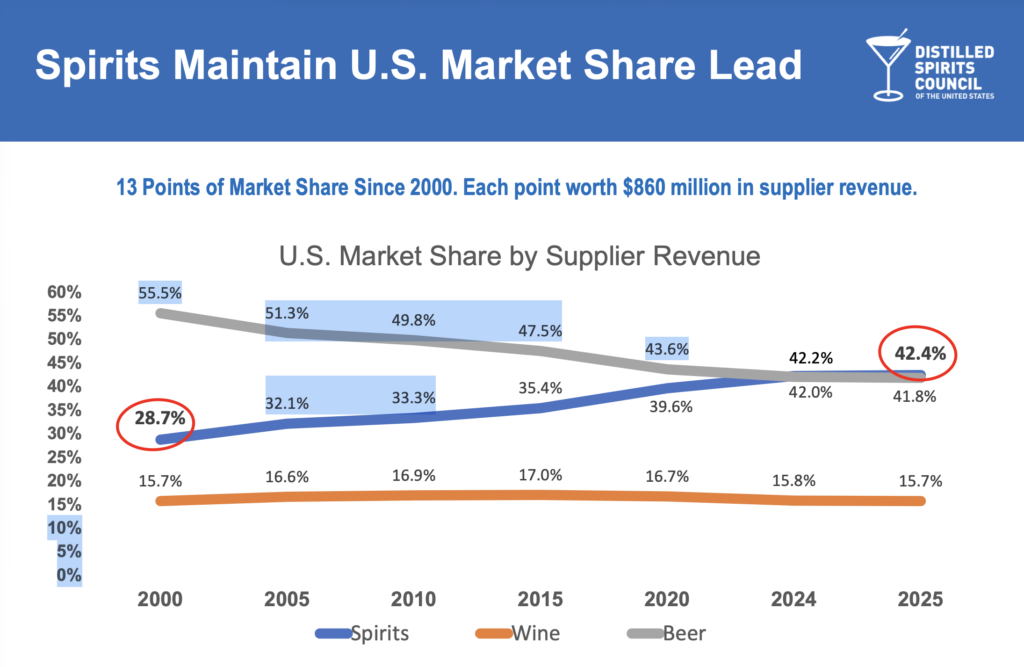

It seems any news story these days is about the decline of alcohol sales and use, and that’s true if you just look at the headlines, but as always, there is context. Alcohol sales are down, but not historically speaking. And while alcohol use has dropped (54% of adults say they drank in 2025 vs 63% in 2023) it remains to be seen how permanent or trending that is. By all measurements, both volume and revenue remain well above 2019, basically the last “normal” year we can point to. Since 2019, the alcohol industry has navigated Covid, supply chain disruption, sales boom during lockdown, slow return to normalcy, tariffs, and economic headwinds.

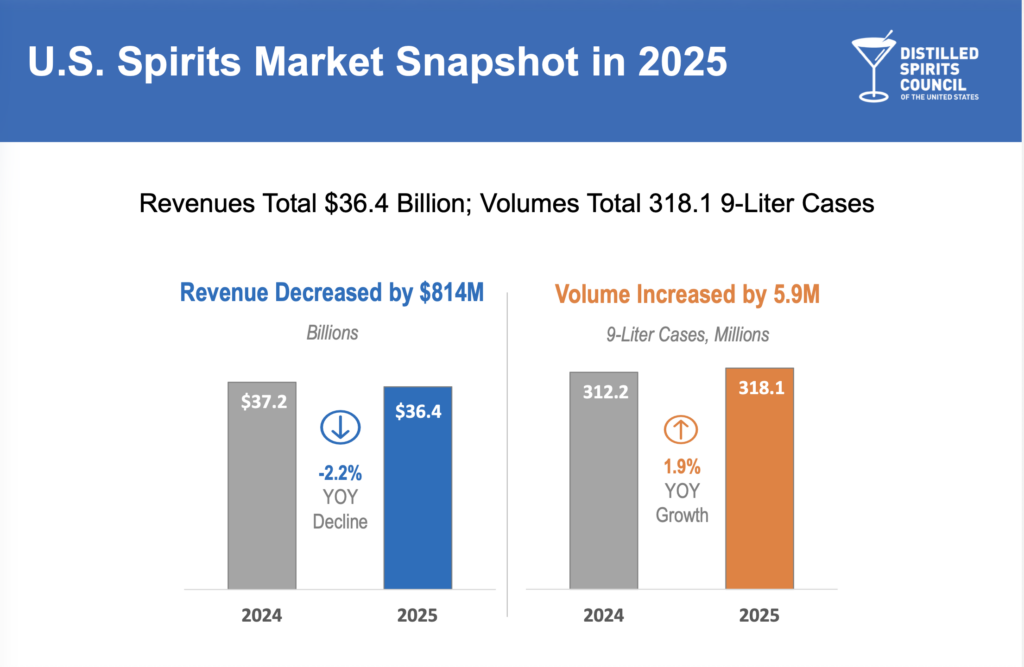

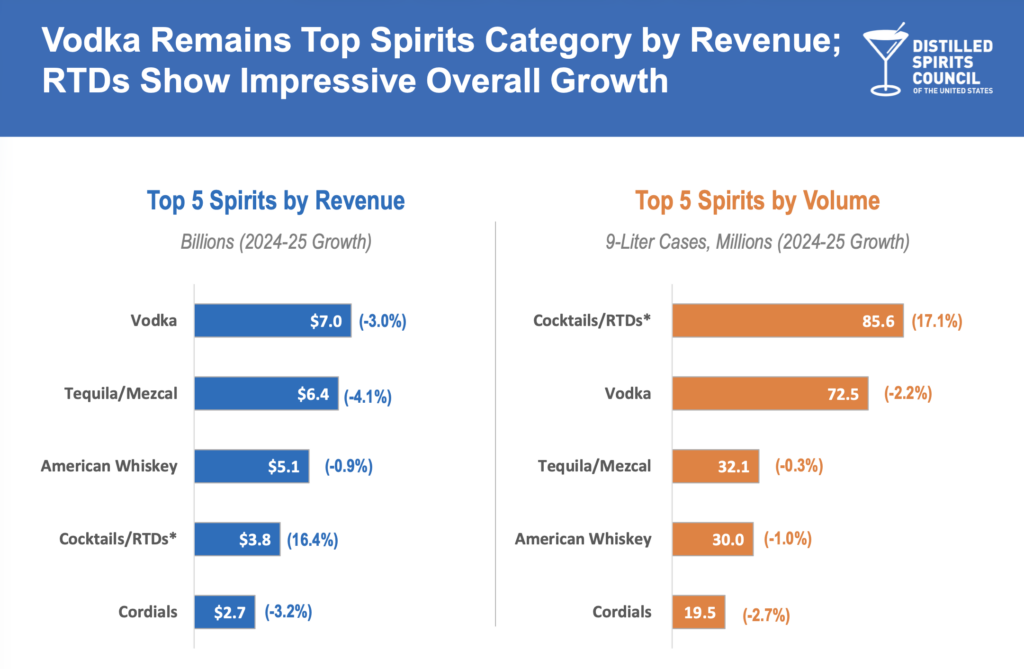

So here are the big numbers: Sales by revenue were 2.2% from 2024 and but up 1.9% by volume, largely driven by continued Ready-to-drink (RTD) growth.

All that talk about Gen Z not drinking? Who do you think is driving those RTD sales? RTDs are the new beer, and the biggest growth area in RTDs is with spirit-based RTDs.

Tequila and mezcal sales were not directly impacted by tariffs in 2025 because they are protected under the USMCA agreement (updated NAFTA), however that is currently under review. But so many other types of spirits and mixers were impacted, driving prices up and hitting hospitality and consumers alike. How much are you paying for a cocktail now?

So what about agave spirits?

According to Nielsen Data, 2025 tequila sales were basically flat compared to 2024, down .4% in revenue. Mezcal sales were down 8.2%.

This is where sales data becomes more complicated and less available. I always try to glean insights from the breakdown of premium/ultra premium sales data to get a sense of what is happening, and from the chart below you can see a downward shift from super premium and high-end premium, or in other words a more price sensitive market. Aside from volume mezcal (Del Maguey Vida, 400 Conejos, Ilegal, etc) most mezcal costs more than $60 a bottle, putting it in those two upper categories. Value spirits grew in both revenue and volume, reflecting the broader market environment: people aren’t spending more.

But this does not tell the whole story because there are some interesting details. According to Nielsen retail data, sales of the top 20 agave spirits brands declined by 1.5%. These brands control about 83% of the market. Other brands grew by 28.5%. This category is mainly comprised of smaller brands that are often more craft oriented. This seems at odds with what we see in the overall premium sales numbers, but since those numbers also include whiskey, scotch, cognac (all of which have been hit by tariffs) it could be argued that agave spirit sales actually kept those high end sales from falling more.

Also, we do not know how much agave spirits sales were and continue to be impacted by the disruptions happening with distributors nationwide. The implosion at RNDC, bankruptcies and layoffs have meant supply chain issues and brands losing distributors, particularly small craft brands.

While tequila focused, The Tequila Report’s “Only the Differentiated Survive: Six trends shaping tequila in 2026” makes some solid points about where the market is headed and what brands need to consider in operating in the current environment.

Until more detailed data points emerge, we are stuck with assumptions or anecdotes about the market in 2025. I know from trips to Mexico last year that there is a lot of mezcal sitting in storage. I know from many conversations with producers that orders for the US market have slowed. I saw a recent post that the cost of espadin agave in Oaxaca has dropped to 50 centavos, or half a peso, for a kilo.

This sets up a cycle that has plagued the tequila category for a few decades; the price of agave goes up because there isn’t enough, more agave is planted leading to a glut, the price goes down, less agave is planted leading to a shortage, the price goes up, more agave is planted, there is a glut, the price goes down and on and on. It is a vicious cycle that at the end of the day harms rural farmers the most.

Is there anything to conclude?

This is the long game look and is completely unrelated to sales, at least for now. 2025 saw Mexico’s biggest year in receiving international travelers, up 6.1% over 2024. Growth came from Canadians, Europeans and Asians, and while the Caribbean coast receives the bulk of international travelers, more travelers are venturing elsewhere. Mexico is on track to be the 5th most visited country in the world. Why does this matter? Because as more people are exposed to the culture and products of Mexico, the more likely they are to want many of those products when they are back home.

There is no doubt that the US remains the largest market for agave spirits. It will take years to supplant the US, if ever. But, producers and brands have to explore other markets if they hope to remain viable. And if ever there was a time to focus on quality and not just quantity, this is it.

**These numbers are all from the Distilled Spirits Council of the United States (DISCUS) unless otherwise noted.

Leave a Comment