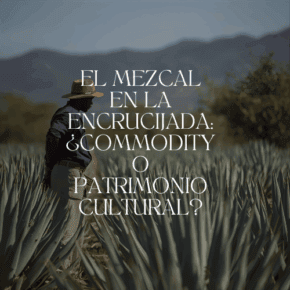

Mezcal, that drink that was once a symbol of cultural resistance and authenticity, is at a critical juncture. We all know about the cycles of La Maguey: our ancestors taught us that the plant owes its life to the moon and feeds on the energy of the sun. We know it’s our duty to be the custodian of this plant that dies upon harvest. But despite our care, the time we are living through feels rather like one of those hellish hangovers from getting drunk on an adulterated beverage.

During the pandemic, mezcal experienced an unexpected boom. Confinement made us drink more. It also made us seek out and identify with new and different experiences. Mezcal was there for us, ancestral and novel at the same time, charged with history, traditions, and an aura of discovery. Many tried it for the first time, some adopted it as a totemic drink, and brands found an expanding market.

That boom, however, was not sustained. What seemed like real growth turned out to be, in retrospect, an ephemeral moment of euphoria. Between 2022 and 2024, we saw a cumulative drop in production of almost 2,803,000, falling from 14,165,505 liters to 11,362,436 liters.

Beyond the hangover metaphor, today we also face a structural distortion: agave prices for mezcal do not respond to the logic of the category, but rather follow the cycles of the tequila industry, where production reached 495.8 million liters in 2024, according to CRT figures.

Every overproduction in Jalisco impacts Oaxaca; every time the price of agave drops in Jalisco, it devalues in Oaxaca. It’s a codependency that shouldn’t exist, because mezcal doesn’t share either the volume or the industrial dynamics of tequila. And yet, mezcal has been trapped in this artificial boom and bust that continuously weakens the category. The challenge is clear: break this codependency and forge our own path, one rooted in sustainable production models, the diversity of agaves used to make mezcal, and a differentiated positioning in the global market.

A first sign of the industry’s fragility is the enormous market concentration. According to figures from the Mexican Institute of Industrial Property (IMPI), there are around 6,000 registered mezcal brands, although it is estimated that only 900 have official certification. However, a few—mainly those acquired by large transnational corporations—account for the majority of sales (IMPI/COMERCAM). The abundance of brands on the market does not reflect a true abundance of opportunities. In almost all cases, the original producers of these mezcals did not benefit from multimillion-dollar sales, and were limited to the continuation of their production contracts under renewed terms. Meanwhile, hundreds of small and medium-sized projects compete for a smaller piece of the pie–without the advantages of distribution infrastructure.

Added to this is the excessive dependence on the US market. Mexico is hit hard when US consumption contracts. The fragility of depending on a single destination highlights the need or the entire industry to follow the example of some brands that have managed to diversify into Europe, Asia, and other emerging markets.

This brings up an unresolved contradiction: Why has one of Mexico’s most iconic products failed to establish a more robust domestic market? For one thing, domestic consumption is inhibited by the current tax policy—which taxes mezcal with a 53% IEPS tax, plus a 16% VAT (on par with mass-produced or even imported alcoholic beverages).

This should be the time to propose compensatory schemes—such as tax exemptions linked to the price of agave—that protect producers and strengthen a domestic market that has so far been neglected.

The fall in the price of espadín agave, which currently hovers around one peso per kilo in Oaxaca, has reduced the value of the entire category and highlighted that, although this variety maintains the largest volume, it alone does not guarantee stability. When espadín becomes cheaper, all mezcal devalues. This reveals something fundamental: biodiversity is the true driver of value. Committing to consolidating mezcal as a specialty product can benefit not only the hundreds of producers, but also the future of major brands, clearly differentiating us from tequila.

The other major risk is the loss of diversity. Mezcal’s value lies in its biological and cultural richness: between 30 and 50 agave species that, in addition to their botanical differences, contribute unique processes, territories, aromas, flavors, and maturation methods. However, more than 80% of production remains focused on espadín. This concentration threatens to erase the richness that makes mezcal unique and push the category toward standardization. The real dilemma is whether we want standardized, large-scale mezcal or a cultural distillate with differential value in the global market.

We also cannot ignore the environmental cost of this industry. Vinazas, a liquid byproduct of distillation, pollute the rivers and soil in communities that produce mezcal. There are no widespread or effective solutions for its treatment. This creates a dangerous contradiction: We talk about respect for the land and cultural heritage, but in many places, production is damaging the ecosystems that sustain it. The future of mezcal cannot be separated from the future of the land.

Given this scenario, the role of new generations becomes decisive. If the mezcal industry wants to ensure its permanence, we must provide space for new talents and generations of agave and mezcal producers to contribute their vision and knowledge, renewing practices and ensuring continuity in the craft.

At the same time, the new generations are setting the course for consumption: they are not seduced by empty campaigns; they demand authenticity, transparency, and a connection with the people behind each bottle. There is a bridge that must be built between both actors: a strong connection between those who produce and those who consume can guarantee not only the permanence of mezcal, but also the authenticity of its culture. Brands that manage to build that bridge and communicate authentically can become beacons of connection and trust.

Exploration is another central feature of this type of consumer. Unlike previous generations, who were married to a single drink, new consumers seek to taste and discover. Mezcal has an invaluable heritage in its diversity of agaves and processes, but this has not yet become a consolidated strategy for positioning the product. And we cannot forget that social life today largely takes place in the digital world. Social media is the new public square: there, not only bottles are displayed, but experiences are shared.

Added to all this is a clear trend: drink less, but drink better. Conscious and premium consumption favors artisanal mezcal, which is not seen as merely a casual drink, but as a cultural experience that deserves time, respect, and ritual.

Here it is worth remembering something fundamental: in mezcal, as in any cultural and agricultural industry, the smallest of challenges deserves maximum attention, because what seems secondary today can become tomorrow’s greatest challenge. If we do not seriously address environmental impacts, species diversity, or market fragility, the entire category will be exposed.

Viable solutions exist. In order to reach them, we must act in a coordinated and collective manner, coherently integrating stakeholders, listening to their voices, and involving them in possible solutions. Forums must transcend the local and understand the specificities of the territory in an international context. Today’s denominations of origin (DOs) function more as a straitjacket, while the development of more specific geographic delimitations could be a springboard. It is time for mezcal to lead this change, allowing mezcals from different territories to develop their own specialty, recognition, and identity. In this way, we can strengthen the cultural and economic diversity of the sector. Only a long-term mindset can give us clarity; We must overcome our short-term and fleeting political dynamics.

Agave, older than corn in the ancestral worldview, is undoubtedly the most important heritage of our country, as Mexico is its center of origin, reproduction, and distribution. What’s at stake is not only the consolidation of a strategic category for Mexico, but also our ability to engage in dialogue and develop public policies that impact many people, especially the most vulnerable, those who have safeguarded agave and mezcal traditions as a unique and ancestral craft. This challenge falls on both the public and private sectors. Only in this way will we avoid the category falling down a dead-end alley. Instead, we can transform the crisis into an opportunity to strengthen mezcal’s position as a premium spirit, a distillation of culture, with a solid future in Mexico and around the world.

The future of mezcal doesn’t necessarily lie in competing with tequila in volume, but in defending what makes it unique: the diversity of agaves, cultural roots, sustainability, and authenticity. The risk of not deciding in time is being trapped in the worst of positions: lacking the scale to compete as a commodity, but losing the authenticity that set it apart.

Mezcal is, without a doubt, one of the purest syncretic expressions of La Maguey. It is drunk in moderation to celebrate, and it has also been wisely used to heal, both physically and spiritually. Mezcal honors birth, accompanies death, and recognizes life in all its stages. It is, in essence, a drink of unification and peace, reminding us that transitions—however difficult—are also a source of reunion and reconciliation.

Today, mezcal needs to pause, breathe, and rethink its path. It’s not just about numbers or markets, but about defining core values: authenticity, commitment to quality, economic inclusion, respect for the land, and cultural recognition. It’s time to decide whether we want to engage in a collective effort, centered on articulating interests and building consensus, or whether we will continue to promote only individual approaches that fragment more than they unite. What is a crisis today could turn into a collapse, but it could also be an opportunity to lay the foundations for a more stable future. Time is running out: if we don’t act soon, tomorrow may be too late.

Excellent article, and thank you for sharing with all of us. Here in Canada, the “drink less but drink better” resonates. If I can drink a nice mezcal that strengthens my spirit, and I know that it’s coming from, and benefitting, a tradition that honours the land and its people, it’s a win-win that I’m willing to invest in bottle by bottle, case by case.

These are all good thoughts, but what are the practical steps to begin? Most brands are going to continue to do their own thing so trying to get any cooperation between them is extremely challenging. What are the actionable steps to start the process of reformation?