Validation

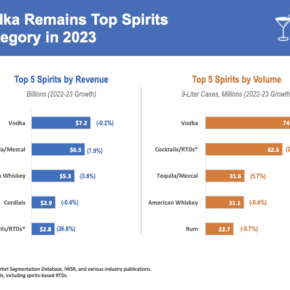

If there is one word that sums up 2017 for mezcal it is “validation.” When big guys like Diageo, Pernod Ricard, and Bacardi get into the category through straight out acquisition or distribution deals you know it is not a passing trend. The repercussions of all these moves have barely hit the market yet so 2018 will be the first time we really get to see how this plays out in terms of the mezcal in bottles, the pricing for bars and on retail shelves. We get the sense that this is as much a dating game for both sides of the equation so we expect lots of smaller changes before anything big happens. The first major trend we expect to see is more of the labels priced for cocktails to expand.

Cocktails rule the roost

But retail is definitely a force

- Mass market placements: It used to be rare to see mezcal at a place like Costco where two liter bottles of major brand spirits were the default. But these sorts of high volume stores are always looking for something new and getting much better at working with brands who can deliver so it’s much more common to see mezcals stocked at Costco, Trader Joes, and, yes, even BevMo. Price is critical on those shelves so this is a great way to sell volume but are these brands really gaining market share or will they just be displaced by the next brand sold at a volume discount?

- The mezcal assumption: This past week I walked into K&L Wines, one of San Francisco’s major wine and spirits retailers. I ran through their mezcal selection, then needed to pick up a bottle of tequila as well so I was surprised to see that mezcals now occupy the same shelf space as tequilas. That’s a pretty dramatic shift from five years ago even if we’re just talking about a market as distinctive as San Francisco.

- Boutique explosion: The time when you couldn’t find a decent bottle at your local boutique liquor store is long passed. These days you’ll frequently find a handful if not a full shelf of carefully curated mezcals because, guess what? The people running these stores frequently are mezcal obsessives and will gladly talk your ear off about everything on their shelves. The more variety they see, the more they stock. Now, can they actually move those bottles?

Media loves its stereotypes

So when we look in our crystal ball, what do we see for 2018?

Mezcal is far greater than Oaxaca

Talking about sustainability

- Agave prices remain high which reflects both a shortage ready for market right this second and tussles over what farmers should get paid.

- While cultivation is seeing an incredible revolution it’s still very difficult to track and verify how agaves are grown. And there are still many labels which highlight the “wild” agave in their bottles which continues to be a very difficult issue.

- Raw inputs like wood and water are open for a discussion that precious few appear ready to really enter. Deforestation continues to be a major problem as does air quality and water pollution from the outputs.

- And then there’s the question of fair pricing. We keep talking about it. Some bartenders are taking a stand. Yet it’s still stubbornly difficult to quantify and discuss.

What does it mean to be a mezcal?

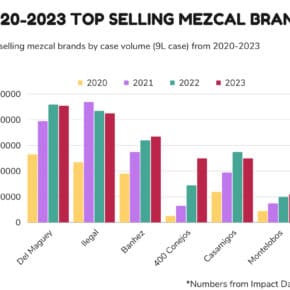

Market shifts

- Surprise brand launches: This is actually the continuation of a trend where we’ve been seeing the quiet release of brands like El Mero Mero which suddenly become well staples or brands like Machetazo which pop up on retail shelves. These quiet launches could be very smart because of low overhead and the obvious sales volume.

- Specialization: On the other end of the scale many smaller brands will launch this year with very different strategies. Cinco Sentidos jumped in with both feet in 2017 by bringing small batch production previously only hauled back to the US in unlabeled garafones. The goal with these brands is to find the customers who prize exclusive, limited production, mezcals. Expect to see more small batch and vintage driven labels like this like Rezpiral, Neta, and Sacapalabras. This is a great sign, let a thousand flowers bloom!, because there really is a universe of Mexican spirits to be explored. Where does it goes from here? Expect experiments with new business models like direct sales through collector clubs or highly specialized retail outlets. People have tried these before but there is clearly a renewed momentum.

- Volume: We will also continue to see the war for the well. Again, we say- STOP! Bar managers, please don’t base your decisions solely on pricing. Focus on the juice that you like, build a program around it, and hold the line on price. Long term relationships will yield extraordinary benefits. If you just chase the dollar, you’re wasting lots of time and are causing long term harm in the market.

- Education: Take all of the above and tie a bow around it, that bow is education and it holds the entire mezcal world together. The more educated bartenders and spirits sales people we have, the better because they’ll choose products on the basis of quality and knowledge, not price and rumor. Education is a major focus for us and will become even more important in 2018. We hear the same thing from every brand, bar professionals, and, most importantly, consumers! Expect more events, more educators, more demand for all of the above.